Table Of Content

Your location determines the risks that are most likely to result in a claim, and the more severe and common those risks are, the more you are likely to pay. Personal liability coverage helps protect your assets if you or your family members are liable for someone else's damage or injuries. Additional coverages may be available to purchase for libel, slander, and other lawsuits. If you need more than a $500,000 liability limit, a separate umbrella policy may provide additional coverage. We offer protection for your home and personal property in addition to liability coverage if you're responsible for another person's injury or damage to their property.

Bankrate Scores

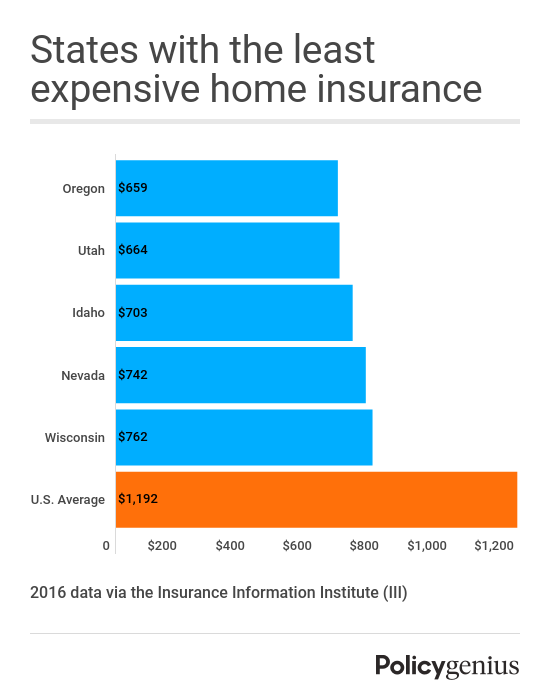

Our team, which includes licensed insurance agents, has analyzed average home insurance cost data provided by Quadrant Information Services. We reviewed rates from every state to help you understand where your premium falls compared to averages in your area, plus offer tips that may help you save money on your home insurance policy. The national average cost of homeowners insurance is $1,582 per year, according to Forbes Advisor’s analysis. This is for a home insurance policy with $350,000 of dwelling coverage and $100,000 of liability coverage.

The 5 Cheapest Homeowners Insurance Companies

Vandalism, theft, fire, lightning and explosion are just some of the problems covered by home insurance. The new rules will allow for rate increases that the company says will ensure they can pay customers’ claims in the event of a fire, according to the statement. Rural areas and cities with low population density typically have lower home insurance rates because rebuilding costs are more affordable. Homeowners insurance premiums vary greatly depending on your ZIP code.

How We Make Money

Florida homeowners insurance: seniors canceling or leaving state - News-Press

Florida homeowners insurance: seniors canceling or leaving state.

Posted: Tue, 23 Apr 2024 09:03:01 GMT [source]

Meanwhile, Congressmen Mike Thomas and Jared Huffman on Thursday addressed the state's growing property insurance crisis. Consumer Watchdog Harvey Rosenfield doesn't believe the regulation changes by Allstate and other companies will benefit homeowners. In March, state farm announced it would not renew 72,000 property owner policies in California. Terry Castleman is a data reporter on the Fast Break Desk covering breaking news. In 2020, he was named alongside his colleagues as a Pulitzer Prize finalist in explanatory reporting. Previously, he worked at the New York Times and volunteered as a first responder for refugees arriving on the shores of Lesvos.

Factors Used to Calculate Home Insurance Rates

Homeowners insurance on a $300,000 house costs an average of $1,754 per year. But this cost can vary widely from $802 to $3,987 per year depending on where you live and other circumstances. Homeowners insurance on a $200,000 house costs an average of $1,298 per year. But this cost can vary widely from $601 to $2,935 per year depending on where you live and other circumstances.

5 Best Homeowners Insurance Providers in Texas April 2024 - MarketWatch

5 Best Homeowners Insurance Providers in Texas April 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

These features help the carrier tie for Best Home Insurance Company Overall in the 2024 Bankrate Awards. Allstate also won a Bankrate Award for Best for Bundling Home and Auto Insurance. Policyholders have the flexibility to purchase a policy, make changes or pay bills directly with its extensive network of agents or independently via the mobile app.

Best homeowners insurance in Texas (TX) 2024

If your home was damaged by an event covered by your policy, like wind, fire or theft, or someone sues you for injuries sustained at your residence, your home insurance policy could step in to cover the damages. For both home and auto insurance, carriers usually place shoppers who are married or in a recognized domestic partnership in a lower-risk group. Shannon Martin is a licensed insurance agent and Bankrate analyst with over 15 years of experience in the industry. She enjoys helping others navigate the insurance world by cutting through complex jargon and empowering readers to make strong financial decisions independently. To determine how much home insurance you need, look at each coverage type and adjust the amounts as necessary.

Check rates from at least three so that you can start to see the range of potential costs. Home insurance plays an essential role if you’re a homeowner, but home insurance costs can stretch well over $1,000 annually, depending on the policy and where you live. The cheapest home insurance cost estimate is $746 a year from Progressive, based on Forbes Advisor’s analysis of nationwide costs among large insurers. Personal property coverage pays to repair or replace your belongings, such as furniture, appliances, clothing and other household items, if they’re damaged or destroyed by a problem covered by your policy, such as a fire. Home insurance quotes are influenced by those factors and companies weigh them differently, so make sure to get quotes from multiple companies to find the best rate for you. Besides tornadoes, hail damage is another reason home insurance rates are much more expensive in Kansas than in most other states.

What is the cheapest homeowners insurance in California?

Once weights were assigned to each ZIP code and company, we were able to calculate our national average home insurance rate. On average, home insurance premiums differ substantially based on how much dwelling coverage is in your policy. Here’s the average annual home insurance rate for five different levels of dwelling coverage. The average cost of home insurance is $1,703 per year for a $350,000 dwelling limit with a $500 deductible, according to our analysis. Home insurance costs will vary depending on the deductible that you choose. Home insurance deductibles options typically range from $250 to $2,500.

While this information can help give you a baseline of how much dwelling coverage to quote, property insurers use their own valuation tool to calculate the actual total of your home’s dwelling amount and annual premium. Once you know the average home rebuild cost in your area, you can multiply this figure by the square footage of your home. There are a number of steps insurers take when deciding how to estimate homeowners insurance.

You’ll want to make sure your current policy fits your coverage needs. For example, you can create a home inventory to ensure your personal belongings are adequately covered. Or you can look into increased dwelling coverage (such as guaranteed replacement cost). The best way to lower your home insurance costs is to compare quotes among insurance companies.

More precisely, you'll want to look at which company offers the best price on the amount of coverage that you need. NerdWallet offers a ZIP-code-based calculator to help you estimate your homeowners insurance premium. NerdWallet calculated median rates for 40-year-old homeowners from a variety of insurance companies in every ZIP code across all 50 states and Washington, D.C. Insurance companies often calculate several of the other coverage limits as a percentage of your dwelling coverage — generally 10% for other structures, 50% to 70% for personal property and 20% for loss of use. The age of your home is also a factor that home insurance companies consider when determining your premium.

No comments:

Post a Comment